A group of business leaders called British North-American Committee examined public sector pensions in the UK Canada and the US. The fruits of their labour is a report called The need for transparency in public sector pensions

Gold-plated pensions extinct in private sector

They began by recognizing that "private companies have considered the rising costs of existing defined benefit provision and decided that the benefits to their companies are often outweighed by the costs and forward liabilities involved." They then looked at public sector pensions to determine the cost to taxpayers.

Part of the analysis was to provide a baseline for the value of the liabilities that existed within these plans and the future liabilities that need to be funded. Their results discovered that in Canada public sector pensions at all levels of government has liabilities of $513 Billion and the public sector plans have accumulated $323 Billion of assets to offset the cost of these liabilities leaving a shortfall of $190 Billion.

I will have to investigate these numbers they appear short of what is actually in these plans. For example, Ontario Teachers had $110 Billion in it last year. As well in Ontario HOOP (Hospitals) and OMERS (Municipal) had another $60Billion and these are only a couple of the many public employee pension plans in Canada.

"In all three countries, the public sector employs a significant proportion of the workforce. Most of the public sector employers in all three countries offer defined benefit pensions (mostly based on final salary) to their employees, and in most cases these are still open to new employees, and also to new pensions accruals for existing employees. This contrasts with the position in occupational pension provision by the private sector in these countries, where many, if not most, defined benefit pension schemes are now closed to new entrants. Some private defined benefit pensions are also now closed to new accruals by existing employees.

The abandonment of defined benefit pensions by the private sector has occurred rapidly, and largely within the last 10 years."

Lack of disclosure to taxpayers on cost of these plans

One of the challenges the group faced in examining the pension was that "Pension finances are notoriously opaque, and indeed this has made the collection of data on the three countries’ public pensions difficult."

If the assumptions of the report are accurate and the methodology seems comprehensive. They have identified why public sector pensions plans have landed into the crisis that exists today. The government's pension assumptions show that the value of the liability of the plans as it exists today is 12% of GDP. A more accurate estimate based on the analysis of the report shows a true cost at 25% of GDP.

Remember these figures are just for plans covering those working in the public sector. This is for teachers, municipal and provincial workers, fire fighters and police. These pension plans are the ones considered gold-plated. These pension retire substantially earlier that the rest of the workforce and the pensions are a guaranteed income into retirement. Not like most pensions based on a pool of accumulated money which is then drawn down in retirement.

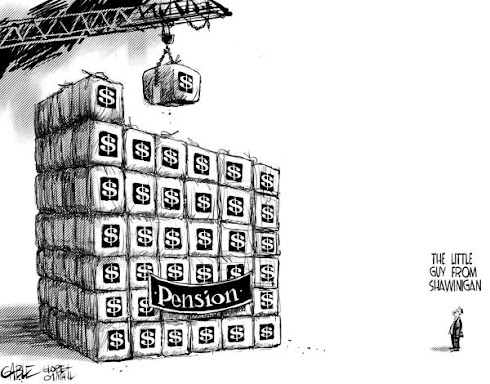

Huge expropriation of taxpayers dollars still fall far short

Although mention was made that Canada has "funded pensions" the funding into these plans has fallen far short of requirements. This was outlined in the report and the analysis shows that contribution into these plans are about half of what they need to be. For example, the federal pension contribution required is estimated by the group to be 45.5% of the income of plan members. However, members are contributing far less than 10% into these plans and the taxpayers is funding the other 35%.

Calculate what your RRSP fund would look like if you contributed 45.5% into every year that you were working. Hence the term gold-plated.

These assumptions have resulted in contributions rates into these plans that are far below what is actually required to fund the full liability that exists today. For example, most provinces estimate a contribution requirement into their pension plans of 14.1% when in reality the real contribution requirement is estimated to be 27.5%. The federal pension contribution required is estimated by the group to be 45.5%.

Public Policy Considerations

"Unfunded public pension liabilities represent a transfer of value (spending power) from a future generation of taxpayers to the current generation of public employees (and by implication, a transfer to the current generation of taxpayers). This decision is made by the current generation, but paid for by future generations.

There is constant electoral pressure to minimize the current tax burden for the electorate, but to make promises of future public expenditure. In the case of public employee pensions, these promises benefit only a small proportion of the electorate, and so it is very important that the promises are known and understood by those who will have to pay for them, and (ideally) paid for at the time of the promise, rather than, say, thirty years’ later, when the promise matures.

The public employee pension schemes in all three countries studies suffer from a strong element of wishful thinking in their choice of discount rate to calculate liabilities"

The report contains some very comprehensive information on public sector pensions in Canada. As well are included some definitions of the concepts that policy makers need to know about.