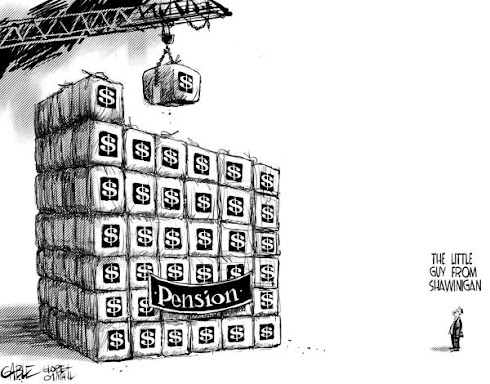

The current practice of paying out generous defined benefit pensions is unsustainable fiscally - and unsupportable politically, Trent said. Two thirds of Canadians don't have any pension plan at work at all, he noted.

"Why should they, through their municipal taxes, be supporting these very generous pension benefits?"

Taming the Beast

We have all seen the monster and we know that the ride he provides for some is very comfortable, but like most monsters, for the average person he is very dangerous.

I was recently invited to a conference in California about pension reform. There was a lot of discussion on how to tame the beast. One idea focused on the ability of municipalities to go bankrupt in order to off load the legacy liabilities they have. Another large part of the discussion surrounded the extent to which pension can be rolled back or more appropriately made more sustainable.

One word of warning is that implementing new rules for future employees will not control costs for the city. The articles above mention that new employees coming into the system are not being hired as full time employees but as contractors. This trend will continue.

Because of the ponzi like nature of defined benefit pensions the need fresh contributors coming in to be sustainable.

Benefits must be amended for existing employees.

A top labour lawyer at the conference examined the concepts that will allow for the changing of future benefits for existing employees. part of it is on vesting rights.

Vesting - Vesting means that you are unconditionally entitled to receive the pension you have earned under the pension plan, whether that benefit is payable now or sometime in the future.

Accrual - refers to the level of benefits that the employee has already earned based on the number of years employees have worked.

Example

Before I begin my analysis let me say that I respect the hard work of police and firefighters across our country. It is part of what makes our democracy strong.

We only need to look across the world to see what is happening in other countries to appreciate what we have here. I am only talking about effective pension management solutions, not denigrating any public sector worker.

Lets look at the firefighter above. Assume we have a firefighter who has worked 15 years. Assume he is earning $70,000 per year.

The usual formula for pension accrual for "public safety workers" is 2.33% for every year the employees works.

Based on his current employment record he has vested his pension with 15 years of working, So based on the formula he will get 2.33% X 15 years equals 35% of his income. He has accrued 35% of his income and this is vested because he has completed this amount of time.

The future earning he has will accrue at the same rate 2.33% and each year that he works becomes another year of "vested" service.

What the big question in Canadian law is "Can the future accrual rate be changed?"

The firefighter when he first began working he had an accrual rate on his pension based at 2%. Changes over the last 10 years have boosted the accrual rate to 2.33%. When the change was made all of his past service was changed to the new accrual rate. This boosted the liability substantially for all municipalities across Canada because the change was made retroactive for all the years public safety employees had already worked.

In this example say a firefighter had been with the city for 25 years. Under the 2% accrual rate he had a vested pension worth 50% of his salary but the day after the pension changes were made he had a pension worth 58% of his earnings. At 30 years the number was 60% versus 69.99%.

Pension earnings in Canada's public sector have always been based on a target replacement ratio of 70% of the worker's salary. So the firefighter above at 30 years working had the target pension at an accrual of 2.33% compared to the old plan where he would have had to work 35 years to get the 70% replacement pension.

Confusing I know.

Potential Solutions

In California the solution that Jeffrey Chang presented was that future accrual rates can be changed but the vesting had to stay in place. This seems like a reasonable solution.

Convert DB to DC

The first solution would be to change the nature of the plan convert it from a defined benefit (DB) to a defined contribution. It is only the public sector that has DB plans based based on these generous accrual rates. The employee would be vested to his current DB portion but any future pension would be based on a DC plan accumulating future pension contributions.

Hybrid - Multi-Tier

Why should the public sector employee get a pension substantially greater than the working Canadian's average wage. Give them a base of say 50% replacement income and any additional contributions they or taxpayers make go into a DC plan. So they would be guaranteed the 50% but any portion over and above would be calculated on a DC formula.

Eliminate Final Pay Formulas

The example for the earnings of the firefighter above is understated. They used a salary estimate that is estimated on the average wage of a firefighter in Montreal. Based on the salary grid and on seniority a firefighter going into retirement has a much large salary. It is the final years that are used to calculate the pension. In the private sector it is done on a career average basis. This opens the door to much abuse in order to raise salaries in the last few working years to enhance pensions. Why use only the last 3 or 5 years of salary to base the pension?

Cap Pensions

What is a reasonable limit for pensions? Our work shows that a formula base on the average working wage is a good solution, Why should a public sector employee retire at age 50 earning for the rest of his life substantially more than the average working taxpayer. A moving formula could be say 1.5 times the average Canadian working wage. This should be more than reasonable pension income. Earlier this week we wrote about an Ontario worker who is currently on track for a $750,000 per year pension, of course funded by taxpayers. An alternative would to be to place a dollar cap on pension for example $95,000 per year. Currently across Canada at all levels there are tens of thousands of retired government workers earning in excess of $100,000 per year in pensions.

Raise the Retirement Age

Canadians in the past had a targeted retirement of age 65. A majority of workers today will work far past that age and a minority will be working into their 70's. Why should the public sector retire as young as age 50?

Eliminate Double dipping

Many of those retired firefighters will continue working after they retire with no reduction in their pensions. Even more insulting many will return to government to continue working.

The conclusion is that changes have to be made. The longer we postpone the changes the more painful it will be for taxpayers and employees.

Taxpayers will suffer big drops in the services that government can provide as they struggle to pay employee legacy costs.

For employees the risk is great too. Many have 40 years to go in retirement. This is a long time and there are many financial challenges that face Canada in the years ahead.

We need to move to pensions that are fair for all and sustainable.

Bill Tufts

Fair Pensions For All